On March 20, 2019, the first high specification CJ46 jack-up rig "SMSMARIAM", chartered by CMIC to Abu Dhabi National Oil Company (abbreviated as "ADNOC"), completed all the commissioning work and officially set sail into the sea for the operating location.

After six months’ hard work and under the exquisite construction and scientific management of China Merchants Industry (CMIH), the rig passed hundreds of rigorous tests of ADNOC on time and set sail smoothly. In the future, under the operation and management of Selective Marine Service Limited ("SMS"), the rig will execute a three-year bareboat charter contract for a daily fee of $20, 000 (after deducting all taxes and operating costs). The bareboat charter contract includes two CJ46 rigs, the second of which is being debugging and is expected to be delivered to ADNOC for operation in April.

ADNOC, the state-owned oil company of the United Arab Emirates, one of the world's leading oil and gas companies and the economic pillar of the Abu Dhabi. It has 95% of the UAE's oil reserves and 92% of its natural gas reserves, ranking fourth in the world. The company produces 3 million barrels of crude oil and 9.8 billion cubic meters of natural gas per day. At the same time, it also has comprehensive business such as refining, transportation, global sales, investment and so on.

China Merchants Industry Holdings Co., Ltd. (CMIH) is a secondary group company in the advanced manufacturing sector of China Merchants Group. China Merchants Group (CMG), being the parent company of CMIH, is a leading central state-owned enterprise. CMG was founded in the Self-strengthening Movement in 1872 and it is the pioneer of China's national industry and commerce as well as a pathfinder of reform and innovation. CMG’s worldwide businesses cover three sectors, focusing on logistics and shipping, financial services, as well as zone development, with a total assets of 7.3 trillion RMB by the end of 2017, ranking first among all the SOEs. CMIH is headquartered in Hong Kong and it also has subsidiaries and institutions aboard in the United States, the Netherlands, Italy, Sri Lanka and other countries, as well as several production and manufacturing bases in East China, South China and Southwest China. The business of CMIH is concentrated in four main areas, including manufacturing of offshore engineering equipment, modification of ship equipment, manufacturing of luxury cruises, as well as manufacturing of new materials and special equipment.

CMIH is the largest shareholder of China International Marine Containers (Group) Ltd. (CIMC), a diversified multinational conglomerate, and invested in more than a dozen companies such as China Merchants Financial Leasing Co., Ltd. and China Merchants Offshore Engineering Investment etc. CMIH also initiated the establishment of China Merchants Great Wall Ocean Strategy & technology Fund of USD1 billion in 2017 and the Fund owns CMIC Ocean En-Tech Holding Co., Ltd. (“CMIC”, formerly known as TSC Group Holdings Limited), a leading global product and service provider of offshore drilling platforms.

With years of experience in in marine core equipment technology, engineering design, manufacturing and project management and operation, combined with the dominant resources and experience of the controlling shareholder China National Engineering Fund in capital operation, investment and mergers and acquisitions, CMIC made its strategic development framework as "Offshore as base, energy as value driver, technology as accelerator, capital as incubator, globalization as foundation". And it is committed to becoming a world-class marine energy science and technology industry chain value integration operator.

The operation and management of marine assets is one of the main business development directions of CMIC.

In 2018, with the support of China Merchants Group, CMIC acquired two 350-feet high specification CJ46 Jack-up drilling rigs with leases to provide offshore drilling services for Abu Dhabi National Oil Company.

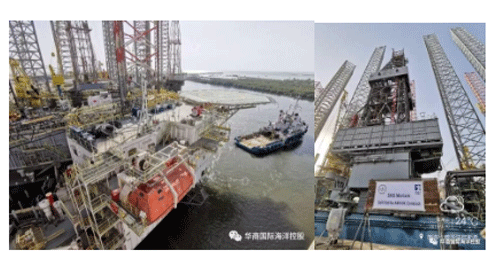

("SMSMARIAM" and "SMSFAITH" are successfully delivered and set sail for the Middle East)

On December 28, 2018, the general meeting of the Company unanimously passed the proposal of financing the rights issue at 1:1, and completed the financing of the rights issue on January 31, 2019. It successfully raised about $660 million HKD which provided strong financial support for the layout of new business and further strategic transformation and long-term development.

In February 2019, together with China Merchants & Great Wall Ocean Strategy & Technology Fund (L.P.) ("Fund") , CMIC signed a sale agreement of two CJ46 Jack-up rigs and a lease agreement for two CJ46 with Shelf Drilling, the world's largest Jack-up offshore platform operator, and acquired about 19.4 per cent shares of Shelf Drilling after which the Fund officially became its largest shareholder.

With the deepening of the transformation and development of all aspects and the preliminary realization of strategic layout, and the new executive team gradually getting along as well as the in-depth refinement of brand strategic management, the departure of the first CJ46 officially marks a smooth start of the international development of CMIC.

So far, CMIC has consolidated the platform of global offshore asset operation and management, by investing in Shelf Drilling and collaborating with world-class oil companies such as ADNOC to speed up the rental utilization and brand influence of offshore assets. Meanwhile, it leverage listed platforms, funds, financial leasing and other capital operation tools in order to provide stable financial support.

In 2019, CMIC will continue to deepen the transformation and development therefore to realize the balanced development among company's offshore asset management, marine equipment manufacturing and oil and gas service business, and at the same time strengthen its belief to overcome the difficulties and break through the predicament of the global offshore industry. With the help of its listed companies and global network resources, the integration of internal and external resources, the integration of asset and capital operation, the integration of "advanced manufacturing" and "operational services", domestic and international integration, and the value integration of the whole industrial chain. By combining the advantages of all parties, a joint force could be formed to break the dilemma of China's ocean engineering overcapacity and to explore a successful way for value integration of the whole industrial chain.