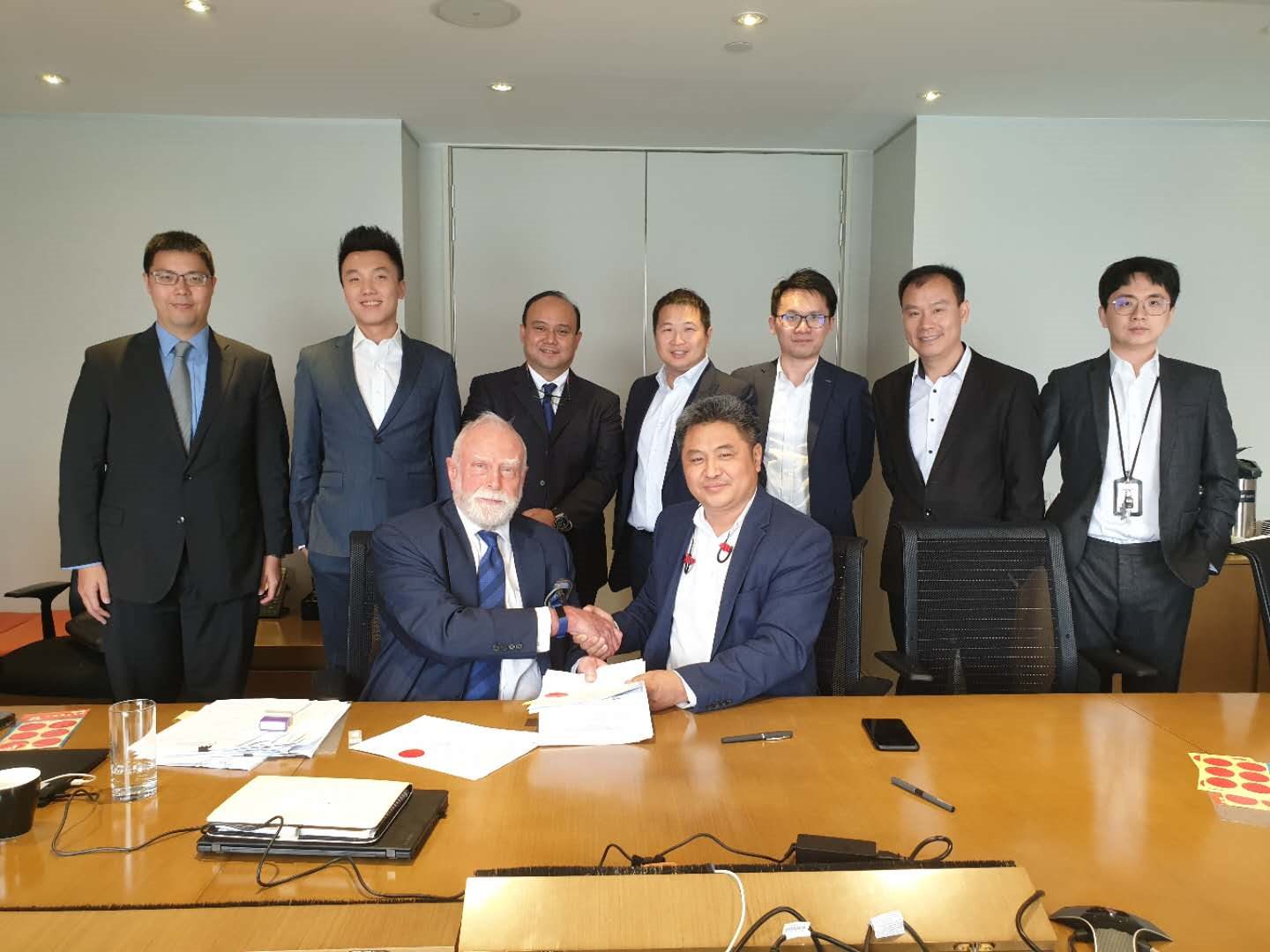

(10 May 2019, Hong Kong)CMIC Ocean En-Tech Holding Co., Ltd. (the “Company” or the “Group” , Stock Code: 206.HK), together with its subsidiary Alliance Offshore Group Ltd (“AOG” a wholly-owned subsidiary of the Company), announced that Wealthy Marvel Enterprises Limited (“JV” or “WME” a 50% subsidiary of AOG), together with China Merchants & Great Wall Ocean Strategy & Technology Fund (the “Fund”), a strategic shareholder of the Company have completed certain agreements with Shelf Drilling Ltd (“Shelf Drilling”). Shelf Drilling is the world’s largest operator of shallow water jack-up rigs.

WME and Shelf Drilling

The Company has earlier made an announcement on 4 March 2019 with regards entering into a series of agreements (the “Agreements”) where WME together with the Fund would acquire 26,769,230 new common shares to hold 19.4% of Shelf Drilling and the sales of two premium CJ46 Jack-up rigs. The agreements were completed on 9 May 2019 with WME completing the subscription of 3,692,308 new common shares and the Fund completing the subscription of a further 23,076,922 new common shares to provide WME and the Fund holding the total of 26,769,230 new common shares. The two units of premium Jack-up rigs were also accepted and delivered to Shelf Drilling on the same day. In addition to the above two units sold to Shelf Drilling, a further two similar units are on track for delivery for bareboat charter on completion of final rig preparation work.

Upon completion of the Transactions, WME will have completed the sale of two CJ46 jack-up rigs and have, together with two units delivered earlier this year for operations on drilling contracts with the Abu Dhabi National Oil Company (“ADNOC”), a total of four units CJ46 jack-up rigs chartered out on a bareboat basis. The Company will be able to recognize charter revenue on commencement of charter operations later in the year.

The conscientious efforts of the teams from both parties to complete the agreements for the investment and the acceptance followed by delivery of the two premium CJ46 Jack-up rigs in less than three months was commendable. This demonstrates fully the active and efficient spirit of cooperation between the parties and determination to develop business synergies together. This phase of completion brings to fruition the successful execution of strategic objectives of the Company to develop an offshore asset management platform. With the recovering oil and gas market and offshore drilling platform utilization and day rates, the Company continues to work with the Fund as our strategic shareholder and Shelf Drilling as a partner to integrate upstream and downstream resources. We intend to gradually build the Company into an effective hub with an integrated platform within the entire value chain covering offshore platform manufacturing, leasing, sales, operation, management, equipment repair and maintenance.

Currently, all parties have reached a consensus on all-rounded cooperation, and has established a platform of reputable and internationally renowned investment institutions, state-owned financial institutions, listed companies and state-owned offshore manufacturing companies. In the future, we will continue to expand asset scale, introduce international strategic investors, engage with domestic industrial and policy funds and continue to enhance capital market opportunities with the support of the Company’s strategic shareholders. And counter-cyclical recovery continues further opportunities will present for cost efficient high-quality assets. This will improve the intrinsic value of assets as market recovers and will provide better returns to shareholders and investors.

With the Company as the hub, building up the offshore industry value chain platform

The Company continues to explore innovative solutions to create value for idle platform assets in the China's offshore manufacturing industry. Through creating value for stakeholders with mutually beneficial deal structures and working with the world's top operational management capabilities, the Company will offer acceleration of investment return to participating enterprises. This will help transform and upgrade China's advanced manufacturing and services, and lay a solid foundation for China's offshore industry to better accelerate professional integration and achieve high quality and healthy development.

About the Shelf Drilling

Shelf Drilling is a leading international shallow water offshore drilling contractor with rig operations across Middle East, Southeast Asia, India, West Africa and the Mediterranean. In 2012, Transocean, the largest drilling company separated its shallow water business, assets, and team to form Shelf Drilling. Through its leading operation capability, excellent management team, fit-for-purpose strategy and close working relationship with industry leading clients., Shelf has long been a leader in the global shallow water drilling service industry Shelf Drilling is incorporated under the laws of the Cayman Islands with corporate headquarters in Dubai, United Arab Emirates. Shelf Drilling is listed on the Oslo Stock Exchange under the ticker “SHLF”. Shelf Drilling fleet consists of 38 jack-up rigs, and one swamp barge.

About CMIC Ocean En-Tech Holding Co., Ltd.

CMIC Ocean En-Tech Holding Co., Ltd. (formerly known as TSC Group Holdings Limited) has the world's leading offshore equipment R & D, design, production, sales and maintenance capabilities, and is one of the few drilling equipment package providers in the world. In February 2018, the Fund became the company's strategic shareholder (holding 51.94%). With the resources of strategic shareholders and years’ experience and global network of offshore core equipment technology, engineering design and manufacturing and project management, combining with the new team's professional advantages in capital operation and investment mergers and acquisitions, we are committed to building a integrate the industrial chain value of the marine energy technology integration operators with variety of financial instruments such as funds + stocks + financial leasing, the world's leading platform operator, and synergy with China's offshore advanced manufacturers and other strategic shareholders.